What are 1-hour payday loans, and how do they work? These are small internet loans that are more frequently used in a pinch. These loans are to be repaid in a short term, usually from two weeks to a month. Traditional loans have a longer approval time, whereas payday loans require a few minutes to apply.

In most circumstances, you must repay the online loan when your next paycheck arrives. As a result, if you want cash, it is not suggested that you utilize the loans for long-term financial demands like paying off your outstanding bills. The loans are designed to cover short-term needs like car repairs and other comparable situations.

What Does the Term "1-Hour Payday Loans" Means?

As previously stated, 1-hour payday loans do not exist. Even if you request a loan at a physical location, getting cash in one hour would be pretty impossible. The lender must review your credit request and ascertain whether you are authorized before proceeding.

Through EmeraldsLending (referral service connecting customers with lenders around the United States), you may get quick cash advances, sometimes even on the same day of a credit request. The procedure is simple, quick, safe, and convenient. It makes getting emergency cash at a time when you really need it a lot easier.

When Do People Use 1-Hour Payday Loans?

Payday loans that are available in one hour are the same as cash loans that are available on the internet. Many people seek payday loans when they encounter a financial crunch. It's also possible that you need funds to offset a budget gap before your next salary arrives, such as for a family vacation or travel purposes.

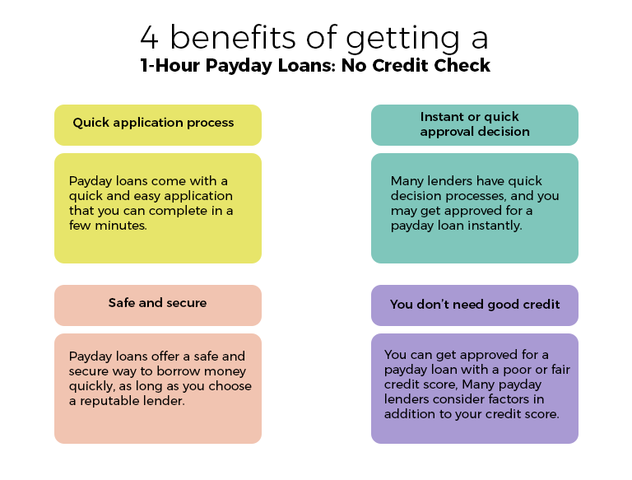

1-Hour Payday Loans Require No Credit Check

Payday loans with no credit check, like any other online loan, are simple to settle. Most online lenders offering payday advances don't rely on your credit score when deciding your eligibility. Instead, they perform a soft credit pull to prequalify whether you can afford to repay the loan.

In fact, no credit check loans exist, but they come with a relatively high-interest rate as any other emergency loan.

Lenders are well-informed that the vast majority of people who look for payday advances have poor credit. Thus, they consider your source of income to make sure you can make on-time payments on a loan.

Minimum Requirements to Qualify for a Loan

1-hour cash loans are simple to acquire. Credit requests are often approved on the same day. These loans do not require a credit check. As a result, solid credit history is not required to qualify. However, to be eligible for these loans, you must fulfill a couple of criteria, such as:

- You must be at a legal age or older

- Be a US resident

- Provide a stable source of income

- Provide active bank account

Other personal details, such as an email address, phone number, and banking information, are also necessary.

Why EmeraldsLending?

Qualifying for a cash advance from a direct lender has various advantages. On the downside, that means you'll only be able to get cash from one lender. So what happens if you don't fulfill their criteria or your credit request isn't accepted?

You'll have to locate a new lender and begin the procedure all over again, causing you problems when you need money quickly. If you secure a loan with a storefront lender, you'll have to travel to the store, which will take additional time and petrol.

So why put yourself through the trouble when the solution is on your smartphone. In just a few minutes, you may fill out a payday loan credit request online and get the cash as soon as in a single business day once approved. Through our website, you may locate multiple lenders online that may provide you with cash loans in an emergency. However, before getting into a legally binding agreement, we strongly recommend looking through credit terms to ascertain whether they meet your expectations.