Payday loans are becoming more and more popular, let’s find out why. What would you do if your car broke down on the highway and you didn't have money to fix it? Or perhaps, a malfunction caused household flooding, and you cannot contact an expert due to lack of funds.

If we continue to enumerate such situations, they may become infinite, as such-like scenarios can occur in our lives at any moment. A payday loan might be the solution to these kinds of problems. If you are unfamiliar with these loans, we are here to give you a rundown and lead you through the process of acquiring them.

Instant Payday Loans Explained

A payday loan is a small amount of money lent for a short period (usually several weeks) that should be repaid in full when a borrower receives their next wage or any other income. Because these loans are designed for those who need money right away and are widely available, the interest rates may be slightly higher.

When the loan's repayment date is due, the lender withdraws funds immediately from your checking account. Thus, the entire procedure, from requesting a loan to repaying it, is completed online.

The Processing of Instant Payday Loans

The processing of the payday loan request may be done from the comfort of your home, freeing you of much turmoil. Moreover, the procedure is so quick that you may obtain the requested funds within a day or even hours, depending on a lender and the amount requested. Here is how it works:

Fill in the online form, provide the required information, choose the needed amount, and submit it.

When we get your loan request, we transmit it to the trustworthy lenders who work with us. The fact that your loan is reviewed by many lenders rather than just one, as is the case with bank loans, boosts your chances of getting approval.

You may get feedback from one or more of our lenders offering to sign a loan agreement (we strongly recommend reading the contract before signing it).

The lender will deposit the appropriate funds directly into your bank account. You may access these funds from the comfort of your own home by paying your bills online or reaching a nearby cash machine.

Instant payday loans: The Eligibility Criteria

Requesting a quick payday loan is not difficult since you only need to meet a few basic requirements. The main factors that play a crucial role in determining your creditworthiness for fast payday loans are:

Age: Borrowers must be of legal age (18 years old and more) to request a payday loan.

US citizenship: Borrowers must be US citizens or permanent residents to qualify for payday loans.

Income: For the lender to approve your loan request, the most significant aspect is your income. Be informed that income may be anything from salary to pension and social security payments. Thus, if you have a consistent cash flow pouring into your account, your odds of getting a payday loan from an online lender are pretty high.

Valid data: Remember that by providing false data, embracing your name, address, social security number, phone number, etc., you will be rejected for getting loans as the lenders carry out soft pulls to verify the information you gave.

Bad Credit & Instant Payday Loans

When applying for a bank loan, you should first check your credit score based on your credit reports from the three major credit bureaus, Experian, TransUnion, and Equifax. Each bureau reports a different score based on various scoring models, the most common of which is the FICO (Fair Isaac Corporation) scoring model. The FICO score typically varies from 350 to 850. The higher the number, the better your chances of obtaining a loan.

Traditional lenders value your credit score, including your credit history, since it allows them to determine whether or not you are a responsible borrower and will return the debt on time. However, let's not forget that life's unexpected events can happen at any moment, and credit defaults are not necessarily linked to the borrower's irresponsibility. That's why our partner lenders do not look into your previous credit failures. Instead, they look at your revenue to ensure that they will receive the funds on time.

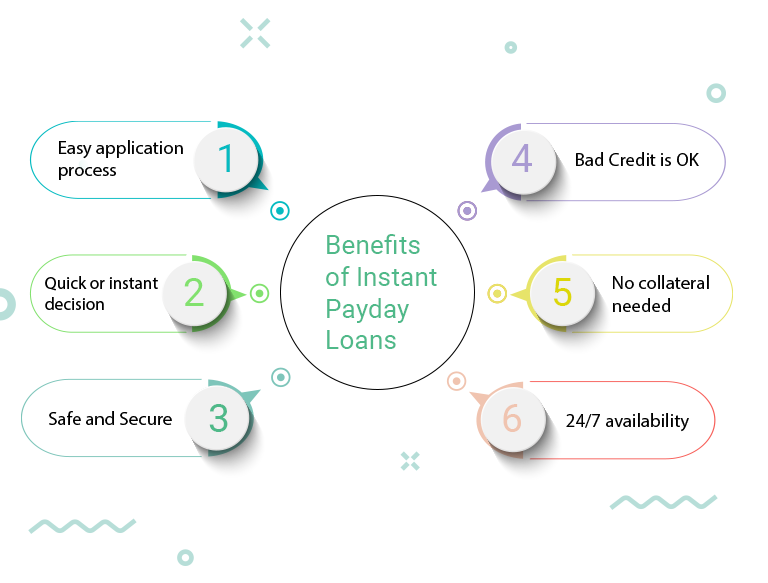

The Benefits of Instant Payday Loans

While speaking about payday loans, many Americans proclaim high-interest rates overlooking all the benefits of these lending instruments. Designed for times when you need to borrow money quickly, these loans help handle financial problems, skipping banks' bureaucratic loan-requesting procedures. Let's look at the six advantages of payday loans:

These Loans Are Easy to Qualify for

The low requirements set by lenders are one of the most important advantages of obtaining an immediate payday loan. While banks and credit unions impose various stringent lending requirements on customers, cash advance providers do not. Of course, there will be soft pulls; but, your chances of getting approved for a fast loan are better than requesting a bank loan. Furthermore, because these online lenders are more concerned about whether you will return the loan, they just look at your current income rather than your previous credit history.

The Loan-Requesting Procedure Is Quick & Simple

Online lenders do not take long to process the request. Emeraldslending suggests a user-friendly platform that allows our customers to fill out a loan request form reasonably fast. Unlike traditional lenders that make you wait days for a loan, you may be able to acquire one the same business day you request it with the aid of our company. Payday loans are an excellent solution for emergencies due to their quick processing.

You Can Use the Cash for Anything

There are no limits on how payday loans can be used. Unlike other types of traditional loans that may be utilized for one purpose (for instance, student loans might cover tuition fees, and auto loans to buy a vehicle), you can spend these cash advances on whatever floats your boat. Though it is not the best way to take avail of these loans, you can even make purchases, organize a party, and so on, with no lender objecting.

You Don't Need to Secure Your Loan

Payday loans do not require any personal property as collateral. Your regular income is adequate proof to the lender that you will be able to repay the borrowed funds. Life is unexpected, and everything may happen; for instance, you may lose your job, unforeseen emergencies may pop up, etc. which may lead to credit defaults. Thus, there won't be any risk of losing your property if you fail to pay your debt.

You Can Submit a Request Whenever You Want

As a sudden financial need might arise regardless of whether the working day is over or the banks are closed, payday loans may be a handy solution. You can submit a request using our website or an app on your smartphone. We are available 24 hours a day, seven days a week, for your convenience.

Our Transactions Are Transparent

After processing your loan request, a lender will give you a loan agreement, including all of the loan terms and expenses. Of course, if something is unclear to you before signing a loan contract, you may always ask questions or even cancel the contract. Thus, we are content to emphasize the openness of our deals and endeavor to assist our borrowers in making informed decisions.

What to Consider Before Requesting Instant payday loans

If you consider taking out online payday loans, you have probably thought about the costs, repayment terms, information security, the consequences of late payments, and other factors. You are not alone; we understand your concerns and have compiled a list of the most common questions and answers to assist you in making informed decisions.

What Are the Costs of payday loans?

According to CFPB (Consumer Financial Protection Bureau), payday loan costs generally range from $15 to $25 for every $100 borrowed, which may translate into approximately 300–400 percent in APRs.

An APR (Annual Percentage Rate) is a yearly interest rate calculation. APRs can be fixed (i.e., they don't change over the loan's lifetime) or variable (i.e., they fluctuate over time). Online small loans typically feature fixed APRs, and borrowers know how much they will pay on their next paycheck in advance.

But remember that these loans are given only for short repayment periods, and calculating their costs by APRs may lead to confusion. Despite the common notion that these online loans trap the borrowers in a debt cycle, we are quick to point out that if you repay the loan on time, there won't be any danger of accruing more debt.

What If I Can't Pay Off My Loan?

If you're facing difficulties repaying your loan, you may be able to request an extended repayment plan (if there is such a point in your agreement) or rollover (if your state law permits) from your lender.

An extended repayment plan allows you to extend the time of repaying your loan. You may be able to acquire more time to repay your loan without incurring any additional costs or fees if your state requires lenders to offer an extended repayment plan.

A rollover is a renewal of the loan agreement between you and the lender that allows the borrower to pay off the interest of the previous debt before extending the due loan date. You will still be responsible for the principal plus the interests and rollover fees. Remember that in some states, online loan rollovers are prohibited.

If you are not given one of these two options (extending the repayment plan or renewing the loan), you can still contact a legal aid attorney to discuss your options.

Are Instant Payday Loans Legal?

Payday regulations vary from state to state. In many states, like Wyoming, Maine, and Wisconsin, online lending is legal; in some others like Arizona, Arkansas, New Mexico, and North Carolina, high-interest loans are prohibited. So make sure to find your state on the list and comply with lending regulations in your state.

How Secure is the Information I Provide?

We understand that there are risks whenever you share sensitive data online, such as when filing a loan request. Scammers abound on the Internet, and they may use your information to conduct fraud. Hence, not everything on the Internet is trustworthy. Here we have compiled a list of pointers on how to spot a secure website.

Padlock: A secure website like Emeraldslending should have a closed padlock next to the URL.

SSL certificate: Always check the URL of the website to see if it says "HTTPS" at the start of the address instead of "HTTP." The presence of "S" will mean that the website has an SSL certificate, which takes the credit for securing the data transmitted to the website's server.

URL errors: Because many people ignore details, some criminals exploit this when perpetrating fraud. A missing letter, a misspelling, and, in some situations, major grammatical flaws are all red flags that the site isn't safe and is most likely a hoax.

Why Choose Emeraldslending?

Emeraldslending’s mission is to help people find instant solutions to financial problems. We support high ethical standards and endeavor to provide trustworthy services while keeping you away from illegal practices.

We prioritize our borrowers’ satisfaction and keep providing free and transparent services. Working with trustworthy lenders, we are sure most clients will find what they are looking for and come back to us whenever in need again. Read our most recent articles if you want to learn more about other credit products available through our website. If you feel you are adequately informed and need payday loans to get back on track with your finances, then click the button below and start the process.