It’s common to take out loans whenever in need of some extra funds to address the budgetary gap. However, it becomes a real challenge for some people to get a loan from a bank, as traditional lenders set very high accessibility criteria. Thankfully, there are alternative borrowing options available on the Internet. These online lenders offer rapid loans with more flexible terms and fewer documentation requirements. In addition, the Internet is full of direct lenders who might be ready to lend money to borrowers with poor credit ratings.

Here are all you need to know about online direct lenders and how to get rapid loans in 2022. Let’s dive in!

Rapid Loans: What Are They?

Rapid loans are a type of borrowing widely available lately. It’s a small short-term loan that got the name ‘rapid’ because of the quick money release. These small borrowings are meant to cover emergency expenses in the middle of the borrower’s paychecks. The payback terms are also short that usually range from 2 to 4 weeks in order not to burden the borrowers with long-term obligations. The premise is straightforward: you take out the loan and pay it back when your next paycheck arrives. The popularity of these loans is primarily related to the soft pulls performed by lenders and their accessibility to all credit ratings.

The Advantages of Working with Direct Lenders

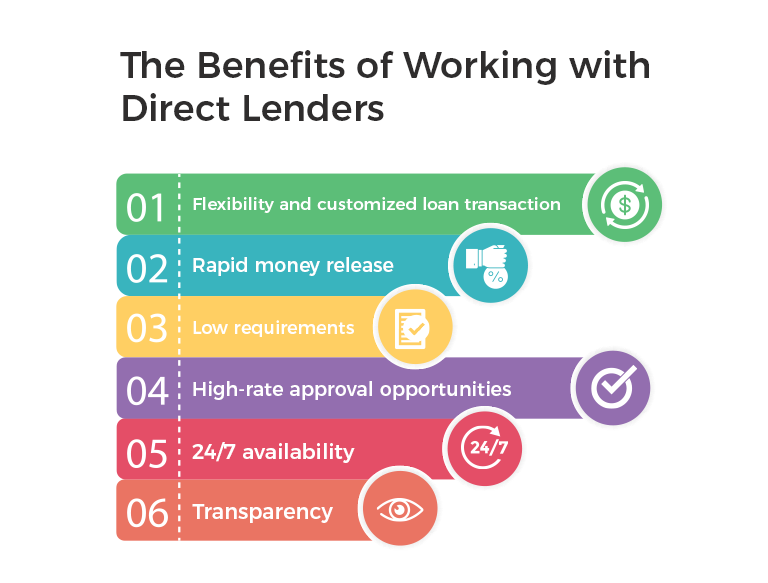

Working with direct lenders, the debtors will enjoy a lot of benefits that embrace:

- Flexibility and customized loan transaction

- Rapid money release

- Low requirements

- High-rate approval opportunities

- 24/7 availability

- Transparency

Flexibility and customized loan transaction: Direct lenders often offer flexible loan terms favorable to middle-income Americans facing financial problems. Compared with banks with strict requirements, these lenders customize the loan offers to meet the customer’s needs. Due to the personalized approach, there will always be something for someone. Even poor credit history can find loans with favorable terms with direct lenders.

Rapid money release: Direct lenders understand your situation and release how important the time is, so they don’t prolong the loan processing with additional requirements. First of all, let’s mention that direct lenders don’t carry out hard pulls, and due to the online operation, they make transactions faster than traditional lenders. Remember that online lenders follow the famous saying “time is money” and strive to speed up the loan processing so that their clientele can benefit from the borrowing.

Low requirements: It’s not a secret that the bank loan is not for everyone, and to access these traditional loans, you have to prove that you don’t need money at all: have a stellar credit score, a high-level income, and a permanent job. That’s why the low requirements of direct lenders make these rapid loans appealing to people who have restricted banking options. The borrowers just need to fill in some basic personal and financial information and submit the request: no additional documents, no time-requiring credit inquiries.

The three main requirements to get a rapid loan are 18 years of age or more, US residency, and steady income.

High-rate approval opportunities: People would like to remove the middleman from any transaction, and the loans are not an exclusion. By communicating with direct lenders freely, the customers will have greater chances of getting a loan with favorable terms.

24/7 availability: Financial trouble doesn’t occur only on working days and hours. Unexpected expenses can arise out of the blue, requiring rapid financial solutions.

The round-the-clock availability is a great advantage that allows working people to apply for a loan just on the go without bothering about the time.

Transparency: Last but not least, we have included transparency in the advantages of working with direct lenders. Though the opponents of online loans accuse the lenders of posing high-interest rates and preying on low-income people, online lenders can always boast of the transparency of their transactions. Before transferring money to the borrower’s bank account, the lenders send them a loan agreement that entails every detail regarding the loan (APRs, repayment terms, all the fees, if any.)

Is It Possible to Get a Rapid Loan from a Direct Lender with a Bad Credit Score?

These borrowings are meant to fill in the void in the lending industry, making the lending all-inclusive for people in need of quick money. While traditional lenders link the low credit score to the irresponsibility of the borrower and assess their creditworthiness by the past payment history, direct lenders consider the latter’s current situation. If the debtor can present proof of the income (salary, pension, side hustle, social security payment, alimony, etc.), they might get these loans irrespective of their past credit failures.

Special Considerations

A direct lender is, as it sounds- direct. There is no intermediary involved in the issuing of the loan. The customers make loan transactions directly on the lender’s website; it is a one-stop-shop. Although Emeraldslending is not a direct lender, we collaborate with them so that you can be sure of the security, speed, and reliability of the loan transaction. Once you submit a loan request on our website, we send your data to the trustworthy direct lenders we collaborate with so that the borrowers can find the best suit for their current situation.

(1).png)