It is not always simple to have a happy life. Your monthly expenses might sometimes far outweigh your income, necessitating emergency cash. That is why understanding what's the difference between a payday loan and an installment loan might be critical. These two are sometimes lumped together since both offer quick financing with relevantly high-interest rates. This is because the borrowers who choose them primarily have bad/no credit and a moderate income. Credit cards and home equity loans secured through credit unions or banks may be unavailable to such subprime borrowers with weak or limited credit histories.

These two forms of loans are frequently the only method for most people to successfully get out of a liquidity constraint. Let's have a closer look at the key characteristics of these loans to see how they differ from one another.

Payday Loans

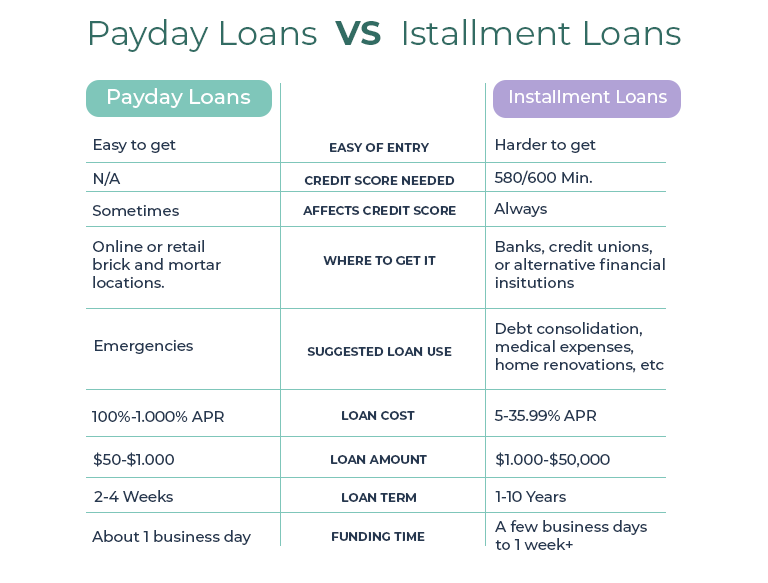

Payday loans are seen as a rapid answer to an unexpected financial difficulty or medical emergency because they have a short payback time and a modest amount of money. Payday loans are available from internet lenders and are generally processed in minutes if you provide accurate information. To be eligible for a payday loan, you must be at least 18 years old, have a steady income, and provide an active bank account.

Installment Loan

Installment loans offer larger amounts of cash and allow to pay it off in smaller monthly installments over a longer period, hence the name installment loan. This loan form is useful to tackle both short and long-term hardships, such as persistent medical diseases. However, because they allow for a larger loan amount, you must verify your reliability in terms of paying off debt on time. This entails satisfying specific requirements, such as having a legitimate checking bank account, a steady source of income, earning at least the minimum wage, and having a good credit score.

Available Amounts

The loan amounts are the most significant distinction between these two financing options. Installment loans offer larger sums up to a hundred thousand dollars, whereas payday loans are small loans ranging from $100 to $2500. This is because, with the latter one, a lender has some type of security proving that you will pay the debt on time. It might be either your good credit score or backed collateral. As a result, installment loans are approved when the lender is confident in the borrower's ability to repay the loan.

Repayment Terms

As the name implies, payday loans are small financing tools featuring short payback terms, with the borrower having just a month or two to repay the total amount. These loans will be paid back once the borrower's paycheck arrives. Payday loans are often cheap, easy to repay, and carry higher risks for the lender, so the repayment time is so short. Installment loans, on the other hand, need an extended payment schedule. Depending on how much money you have borrowed in the first place, it might take anything from a few months to a few years (for a mortgage, it might be up to 20 years).

The Payment Mode

Installment loans are repaid in equated monthly installments (EMI). Throughout the loan term, a certain amount of money is transferred to the bank monthly. As a result, It's paid monthly until the entire debt is settled. On the other hand, payday advances are repaid with a post-dated check provided to the lender after the loan is taken out. Repayment can be made online once the debtor's paycheck has been sent to his bank account.

Applicable APRs

With a payday loan, the cost of borrowing can be computed using a concept known as APR, reaching up to three-digit numbers. In plain language, payday loans offer higher interest rates than installment financing. Installment loans have lower interest rates, extending from 10% to 50%. Other financial expenditures, such as credit insurance premiums, might be paid in monthly installments in addition to the interest.

Security

Payday advances are usually riskier than installment loans. This is mainly because payday financing isn't backed by the borrowers properly, unlike installment advances. Indeed, any valuable asset might be used as collateral to back up debt, such as real estate, automobiles, and jewelry. This minimizes the risk and gives the lender a better chance to recoup a loss if the borrower defaults on the loan.

However, payday advances carry a larger risk, especially when considering the requirements that must be met before the loan is approved. For example, you must produce recent pay stubs to prove your work status and a steady income source to be considered for payday financing. Plus, you may be required to provide a post-dated check that equals the amount borrowed plus fees. The main thing that lowers the risk is that borrowers are only provided modest and easily repayable loans.

Which One to Choose?

As a final analysis, your unique situation and personal preferences may influence the sort of loan you will decide on. For example, many people prefer to take out a short-term loan since it allows them to pay it off quickly while also improving their credit score. On the other hand, others reject devoting their whole next salary to repaying current obligations, preferring to spend the months ahead paying off the approaching loan gradually.

One point to remember is that even with bad or no credit, you may have a chance to qualify for both payday and installment loans. Nonetheless, don't consider more than one loan at a time since this can significantly disrupt your finances and provide a flood of new troubles to cope with.

To summarize, if you want a larger amount than a payday loan allows, an installment loan is likely your best option. Remember, you should only decide after assessing your current requirements and potential financial concerns. If you're still unsure, you may always request different types of loans and then pick the one that best fits your needs.